Fixed Deposit Rates in Nigeria Business 17 Comments Fixed deposit is a lump sum deposited with a bank for a varying period in exchange for interest. Mutual Funds are operated by professional investment firms made up of people who are savvy with the money and capital market.

10 Best Forex Brokers In Nigeria 2021 Regulated Brokers

Fixed deposits are a form of time deposit.

How does fixed deposit work in nigeria. Mutual Fund like in Nigeria can be operated by the Investment arm of banks stock brokerage firms investment banks etc. GTBank offers you the opportunity to have a fixed deposit account where you can earn monthly deposit interest based on the amount fixed term duration as well as the interest rates. The rate of interest is decided according to the chosen tenure and an assurance is paid for keeping the funds for a particular period.

Nigerian banks fixed deposit rates differs from one bank to the other. These tenures can vary anywhere from one month to five years. Fixed Deposit Account Grow your money with this account that lets you invest a specific amount of money for a fixed period of time at an agreed interest rate.

The interest rate for Stanbic or any other bank offering fixed deposit is normally based on a 12 month. Minimum of 30 days maximum of 180 days. Fixed deposit is a large sum of money deposited with a bank for an agreed period in exchange for interest after investment.

Interest rate and tenure is subject to customers preference. As a market maker broker AvaTrade uses internal liquidity pools and a dealing desk to execute orders. We have listed the best top banks in Nigeria with their various interest.

824am On Dec 16 2009. Also be aware that you will need to have an existing account with the bank and then you deposit the agreed sum you want to fix into this account. Fixed deposit is a large sum of money deposited with a bank for an agreed period in exchange for interest after investment.

In return for the higher interest rate you promise to keep your cash in the bank for a specified amount of time for example six months 18 months or. All banks in Nigeria offer this investment opportunity however the rates you get when you invest in one bank may differ from what you get from another. With the high rate of inflation back home then it probably does not make economic sense to deposit your money in fixed deposit because your Naira would depreciate in the long run.

You will need to have an existing account with the bank of your choice and then you deposit the sum you want to fix into this account. Fixed deposits offer attractive interest rates and runs for a pre-defined tenor. A fixed deposit is a large sum of money deposited with a bank for an agreed period in exchange for interest after investment.

When you select a tenure you are deciding to put your money away and not touch it for a period of time one month three months six months one year etc. The account holder has to deposit the funds at the time of opening the FD account and select a tenure. How is it different from a stockbroking firm.

Nigerian banks with highest interest on Fixed deposit accounts Reply by Felix Okoli on Saturday June 15 2013 at 124147. Interest Rate On Fixed Deposit Accounts In Nigeria by zobay m. We have listed the best top banks in Nigeria with their various interest rate for you to compare and make your choice below.

Examples of AvaTrades average fixed spreads. Fixed deposits are excellent and the most preferred option by risk-averse investors to multiply their hard-earned money. Some banks like WAMU and HSBC are offering rates of 5 and 6 which actually boosts the value of your money because inflation in the states generally isnt high it is around 2-3 percent for consumer goods.

When you open a fixed deposit account you have the option to choose a tenure also known as term. A fixed deposit is an investment with a specific amount invested at an agreed interest rate and tenor. Following a fixed pricing model the brokers fixed spreads are commission-free and do not fluctuate with changes in market conditions as variable spreads do.

So you can invest your money and know exactly what you will receive at maturity Risk free returns on your investmentFixed deposits offer attractive interest rates and runs for a pre-defined tenor. Hi Chinedu if you want to invest N300000 into a fixed deposit account and the interest rate is 10 you would make around N30000 per year from that investment. Nigerian banks fixed deposit rates differ from one bank to the other.

Minimum investment ti start with is 50k and minimum tenure of investment is 90daysThis is real deal. 29 rows Demand Deposit. A fixed deposit is a financial tool used by banks to offer customers with.

Interest received is not subject to tax. Interest with principal can re-invested immediately after the end of the agreed tenure. Nigerian banks fixed deposit rates differs from one bank to the other.

Nigeria Interest Rate Nigeria Economy Forecast Outlook

Learn How Fixed Deposits Work Punch Newspapers

Generalized Geological Map Of Nigeria Showing The Locations Of The Download Scientific Diagram

Full List Of Nigerian Banks Ussd Codes Coding Mobile Banking Cellular Telephone

Fnb Flexi Fixed Deposit Interest Rates 2021 In 2021 Savings And Investment Banking App Online Banking

Nigeria S Piggybank Ng Raises 1 1m Announces Group Investment Product Techcrunch

Chymall Nigeria It S A Real Business Not An Investment Ideasdome Investing Passive Income Opportunities Business

Effect Of Audit Quality On The Financial Performance Of Deposit Money

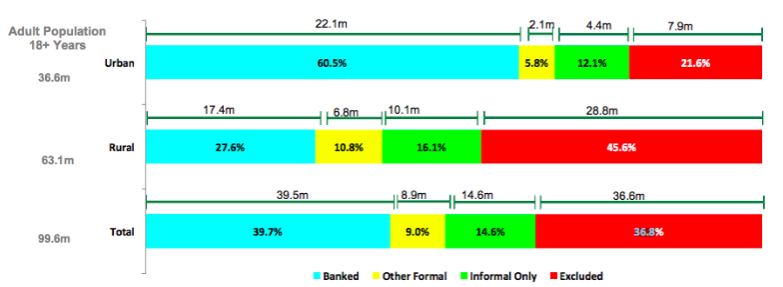

Nigeria S Banking Sector Thriving In Crisis Mckinsey

Payments Banks Nigeria Takes A Page From India

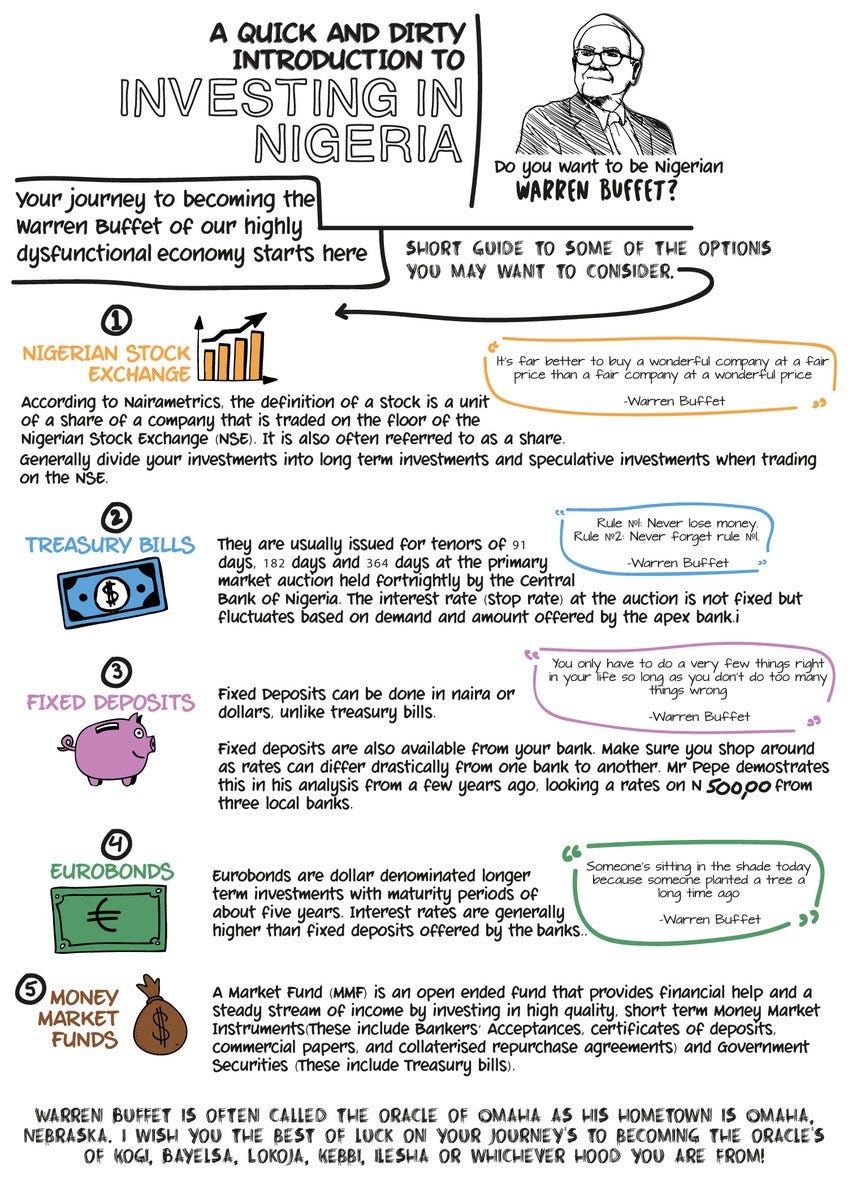

A Quick And Dirty Introduction To Investing In Nigeria By Dr Ola Brown Orekunrin Medium

Nigeria S Banking Sector Thriving In Crisis Mckinsey

Nigeria S Banking Sector Thriving In Crisis Mckinsey

Best International Online Brokers Of 2021 For Citizens In Nigeria Fee Comparison Included

Pdf Interest Rates And Loan Performance Of Deposit Money Banks In Nigeria

Fixed Deposit Interest Rate In Nigeria Investsmall

Fixed Deposit Rates In Nigeria

Nigeria S Piggybank Ng Raises 1 1m Announces Group Investment Product Techcrunch