Mutual funds are investment products which pool money from numerous small investors to create a fund. As an investment instrument offered by banks and NBFCs non-banking financial companies Fixed Deposit is a great way to grow your savings with utmost safety.

How To Close Fixed Deposit In Canara Bank Bank With Us

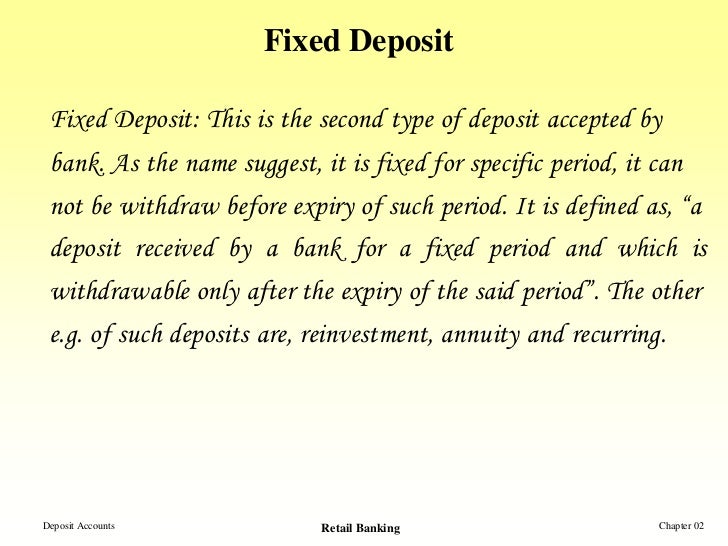

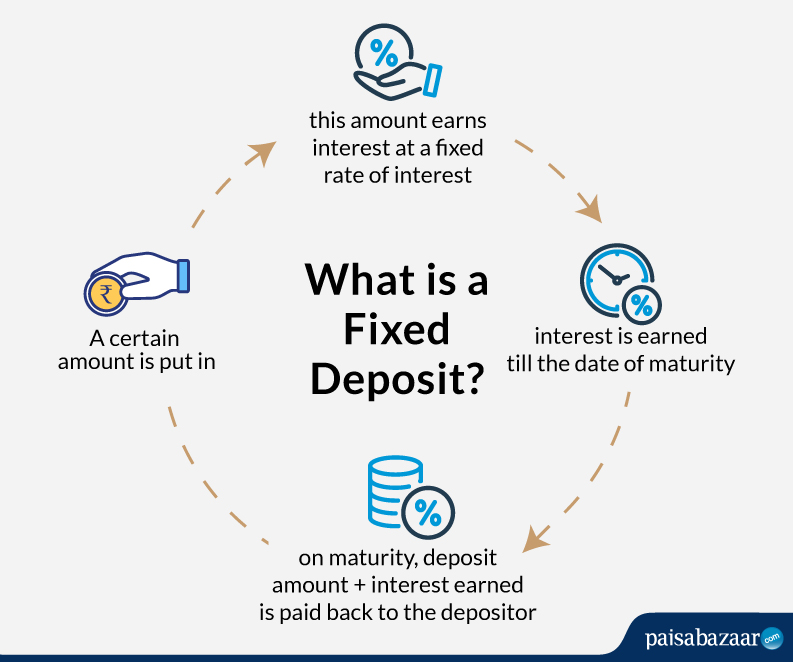

Under fixed deposit account money is deposited for a fixed period say six months one year five years or even ten years.

Fix deposited meaning. The money deposited in this account can not be withdrawn before the expiry of period. In deposit terminology the term Fixed Deposit refers to a savings account or certificate of deposit that pays a fixed rate of interest until a given maturity date. The amount deposited in the National Saving Certificate gets tax exemption under Section 80C of the Income Tax Act.

A fixed deposit with a bank is a savings instrument which enables an individual to invest a certain sum for a fixed period of time. Through an FD people invest a certain sum of money for a fixed period at a predetermined rate of interest in an FD. You can invest any amount in NSC.

It is one of the most preferred avenues that enables you to deposit a lump sum amount with your financier and choose a tenor as per your convenience. A person investing or assuring a fixed lump sum amount needs to be aware of the fixed rate of interest levied on the principal deposits. A joint account can also be opened in the name of a minor and in the name of 3 adults.

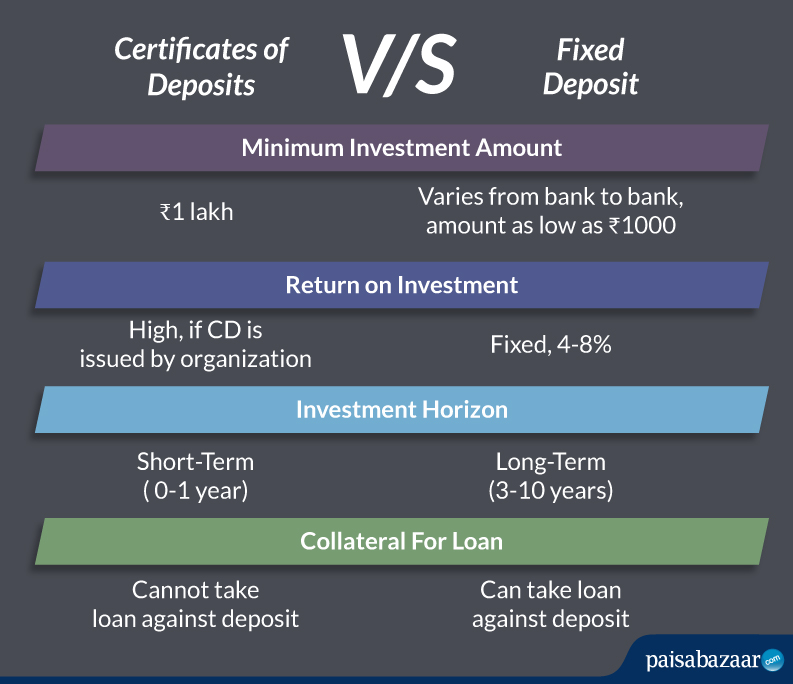

Foreign Currency Fixed Deposit FCFD is a fixed investment instrument in which a specific sum of money that is poised to earn interest is deposited into a bank. Fixed deposits are also known to generate high and guaranteed returns and set high-interest rates as compared to savings accounts. In a Fixed Deposit you put a lump sum in your bank for a fixed tenure at an agreed rate of interest.

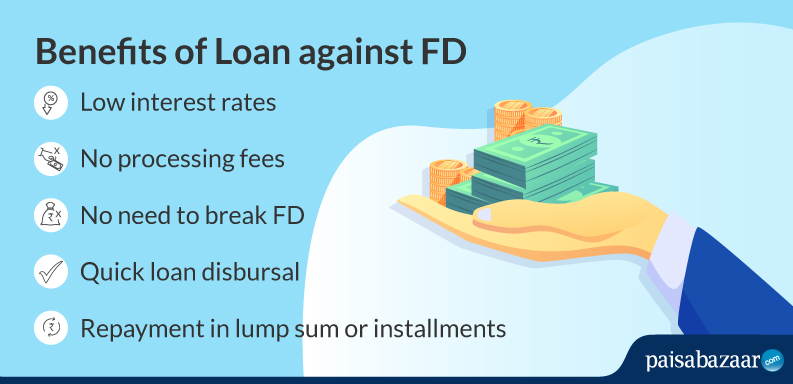

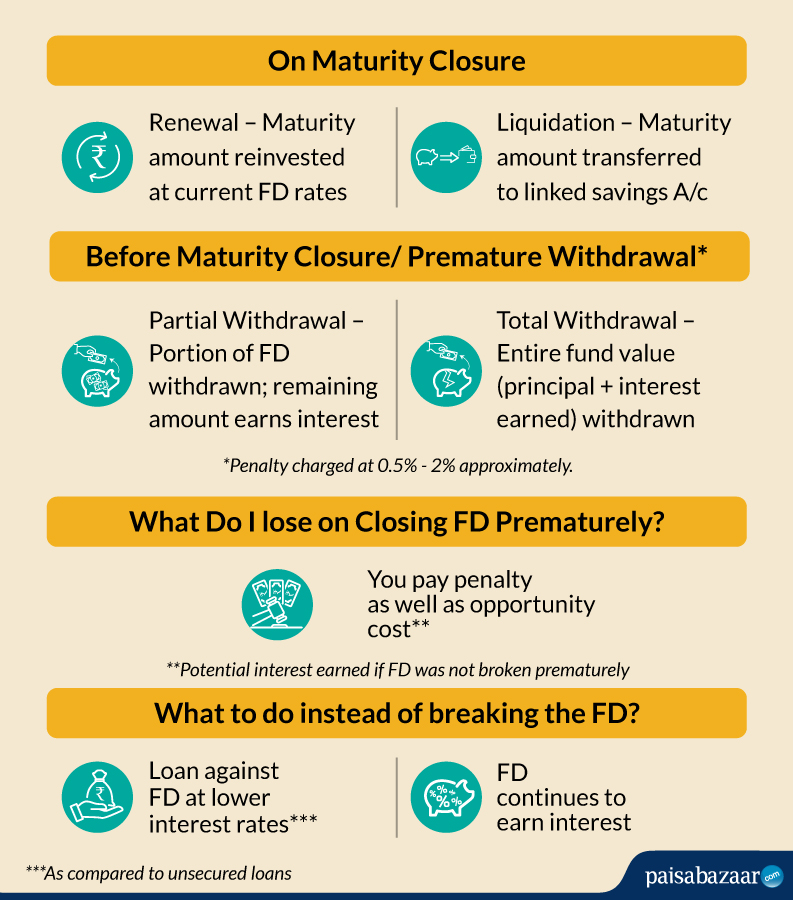

In the meantime you can take loans against your fixed deposit or simply hold on to them while they accumulate interest. What is a Fixed Deposit. Dont be surprised if during an emergency your financial adviser or wealth manager suggests re-allocating more to simple fixed deposits.

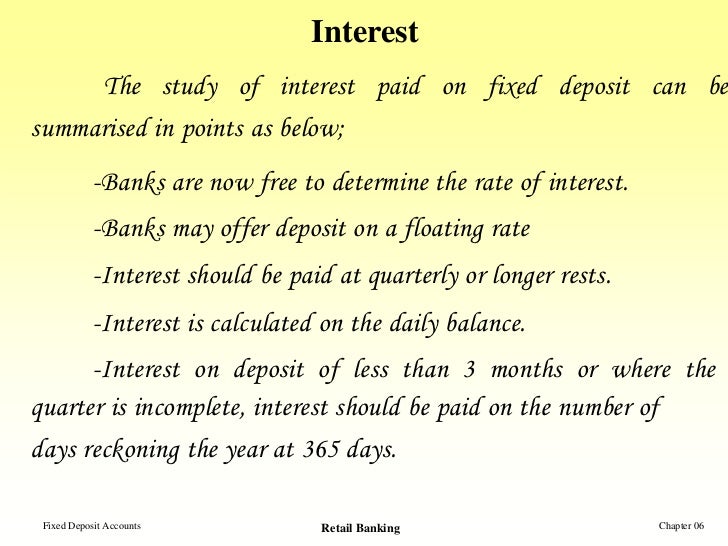

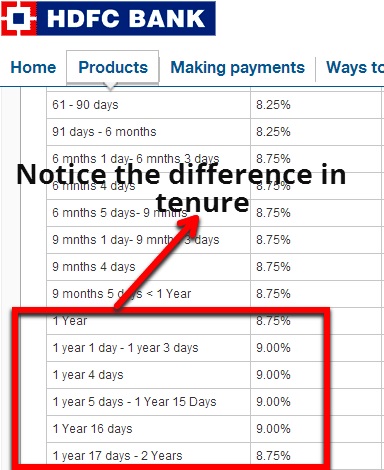

Fixed Deposits FDs are a type of investment offered by banks post offices and even corporates. At the end of the tenure you receive the amount you have invested plus compound interest. The rate of interest paid for fixed deposit vary changes according to amount period and from bank to bank.

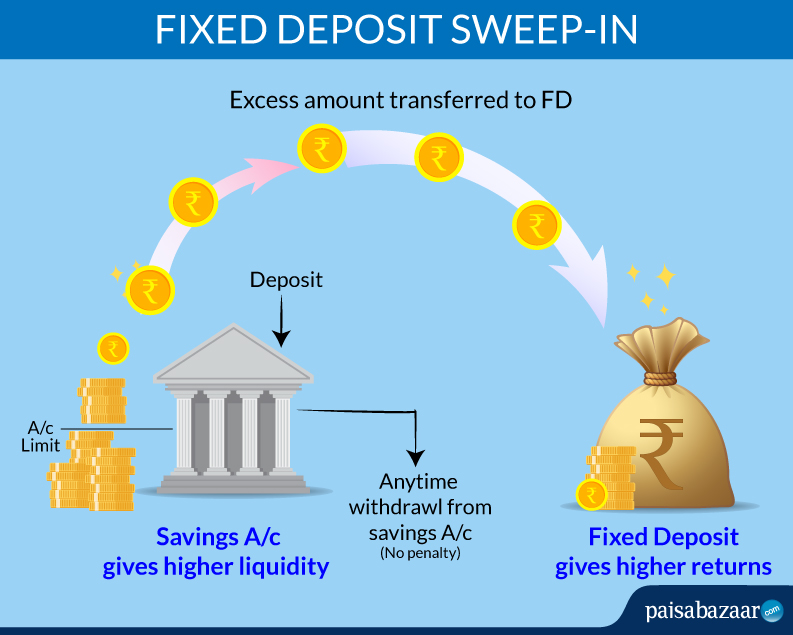

There is no maximum investment limit. And the feature that allows a depositor to withdraw partial or. Fixed Deposit FD are saving tools offered by banks to deposit lump sum amount for a fixed period of time on a higher interest rate than saving accounts.

Funds placed in a Fixed Deposit usually cannot be withdrawn prior to maturity or they can perhaps only be withdrawn with advanced notice andor by having a. Fixed deposits are loan arrangements where a specific amount of funds is placed on deposit under the name of the account holder. The added interest will be based on the term of the fixed deposit account.

When investing in a fixed deposit the interest is compounded regularly and you have the option to receive your interest at maturity or on a periodic basisFor those looking for steady growth of capital investing in a cumulative fixed deposit is a great option as you get a lumpsum amount at maturity. Fixed deposits are considered to be one of the safest modes of investment. In return the investor agrees not to withdraw or access their funds for a fixed period of time.

When it comes to fixed deposits it is termed as an investment because of the added interest. To open an NSC account you have to invest a minimum of Rs 100. What is Fixed Deposit FD Fixed deposit is an investment vehicle which allows investors to put their idle money into and turn it into guaranteed returns.

A fixed deposit or an FD is an investment instrument that banks and non-banking financial companies NBFC offer their customers. Although fixed deposits have. In a fixed deposit interest is only paid at the very end of the investment period.

So what exactly is a Fixed Deposit. The money placed on deposit earns a fixed rate of interest according to the terms and conditions that govern the account. Because fixed deposits are guaranteed and insured they can be used to safely hold money until things settle down.

FDs are also called term deposits. Everything you need to know about Cumulative Fixed Deposit. A fixed deposit or FD is a type of bank account that promises the investor a fixed rate of interest.

What Is Fixed Deposit Meaning Interest Rates Benefits Risk Bank Fd Vs Corporate Fd

Types Of Deposit Accounts Saving Deposit Savings Deposit Account Is Meant For Individuals Who Wish To Deposit Small Amounts Out Of Their Current Income Ppt Download

What Is The Difference Between Certificate Of Deposit And Fixed Deposit

Bank Deposit Accounts Types Demand Term And Flexi Deposits Lopol Org

Fd Vs Rd Which Is The Better Option Paisabazaar

Bank Fixed Deposit Fd What To Do When Depositor Dies Before Maturity Basunivesh

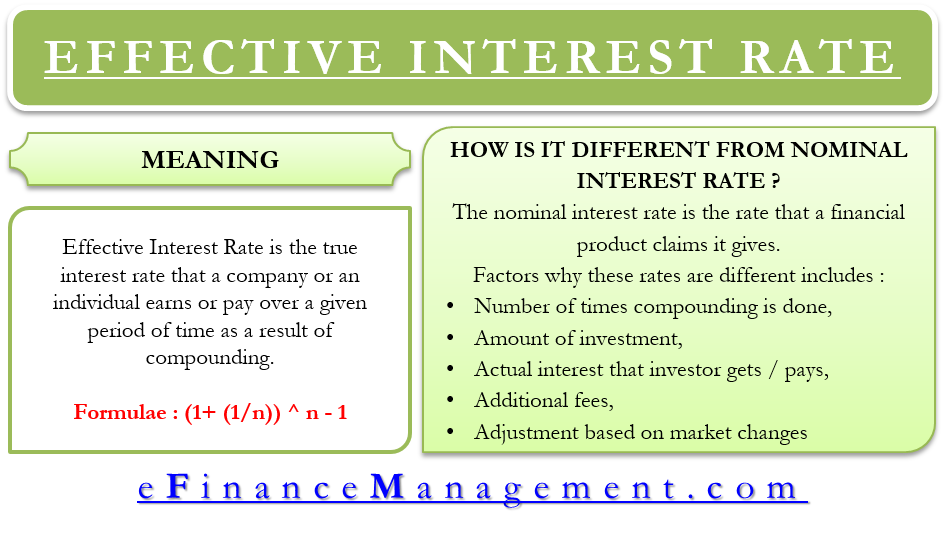

Effective Interest Rate Meaning Formula Importance And More

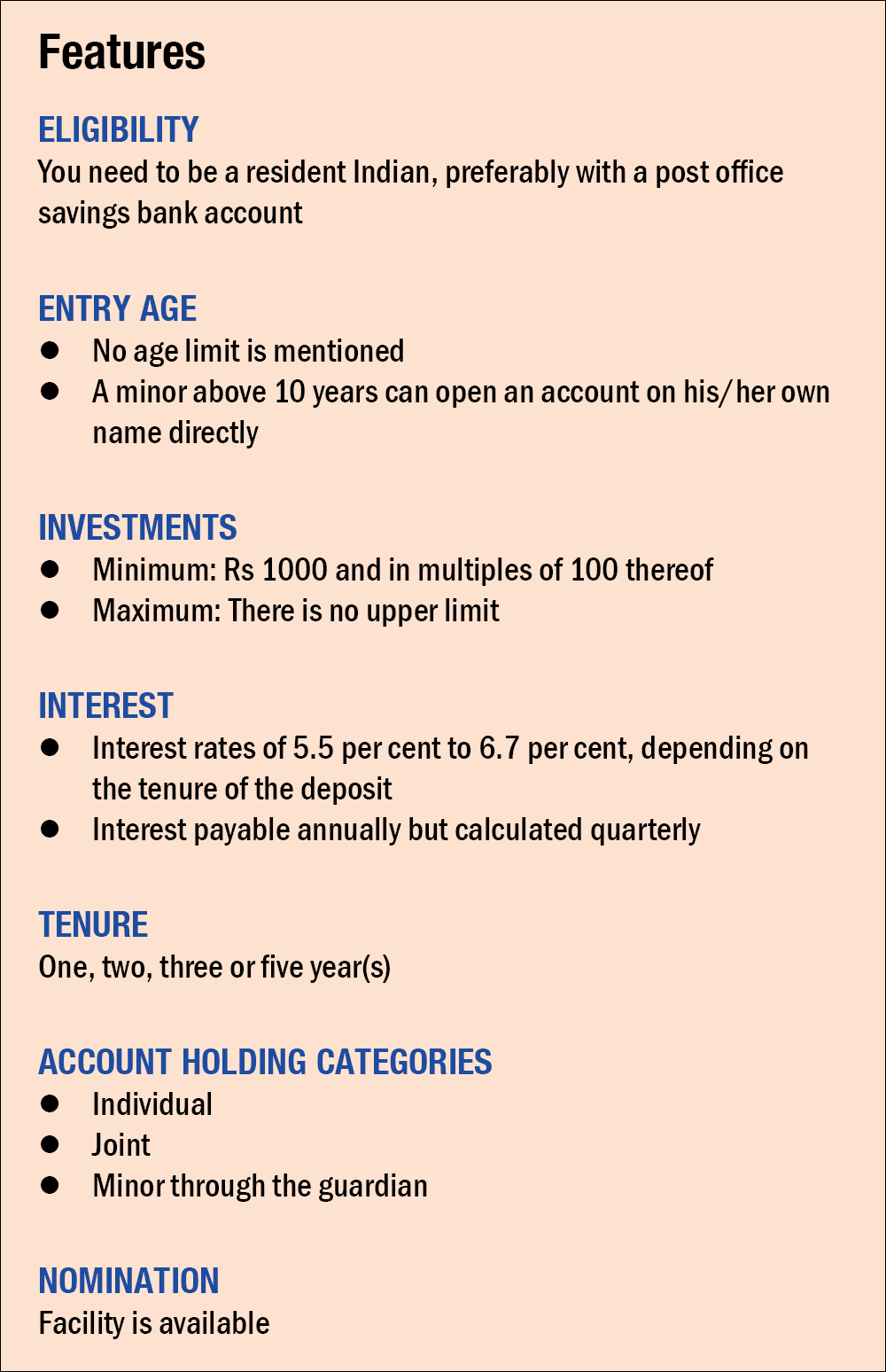

All About The Post Office Term Deposit Value Research

What Happens If You Don T Renew Or Withdraw Your Fixed Deposits

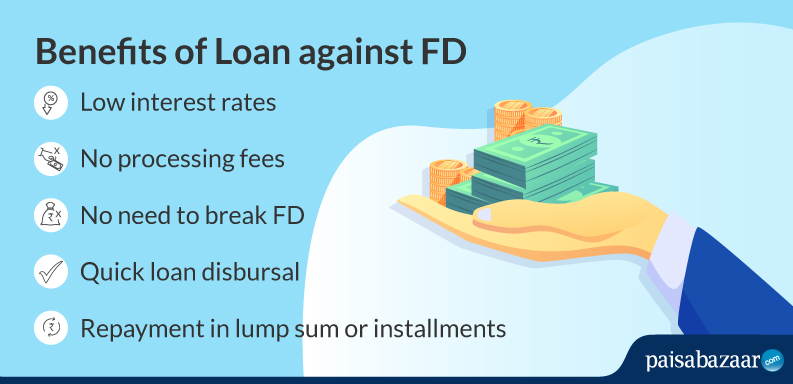

Loan Against Fd Fixed Deposit Overdraft Against Fd 2021

Fixed Deposit Account Fixed Deposit Maybank Malaysia

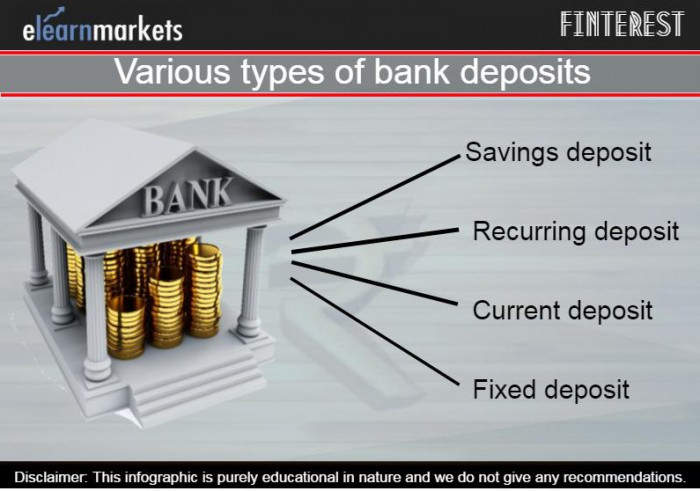

Various Types Of Bank Deposits Bank Accounts In India

Bank Fixed Deposit Fd What Happens If You Not Renew Or Withdraw It

How To Close Fd Sbi Hdfc Icici Pnb Axis Bank I Paisabazaar

Fixed Deposit Sweep In Hdfc Yes Bank Sbi Icici Bank Paisabazaar Com

What Is Fixed Deposit Meaning Interest Rates Benefits Risk Bank Fd Vs Corporate Fd

What Is Fixed Deposit Fd Definition Advantages Of Fd Account